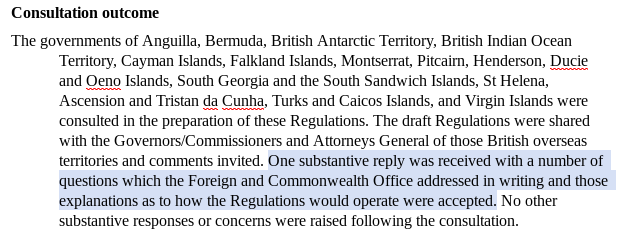

The stream of statutory instruments trickles onwards, occasionally throwing up the odd nugget of interest. Back in January “The Overseas Association Decision (Revocation) (EU Exit) Regulations 2019” was considered for sifting, these instruments come with an explanatory memo that should say in normal language what it was trying to do and it also lists what consultations the government did when writing it. This one is something to do with how the 52% in their ignorance screwed the overseas territories (who didn’t get to vote on being screwed over), but the consultation had something that caught my eye:

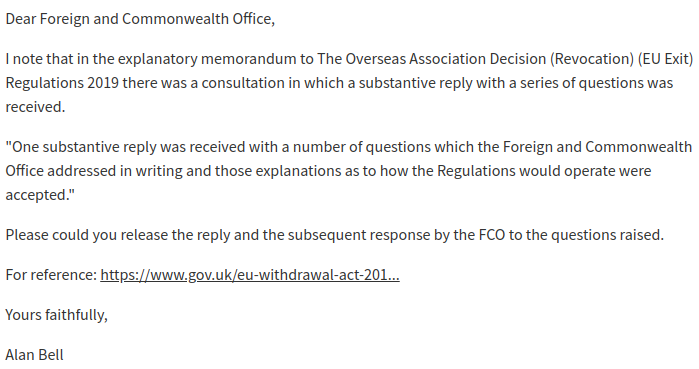

So there is a document, and if a document exists then a freedom of information request can be used to get it perhaps . . .

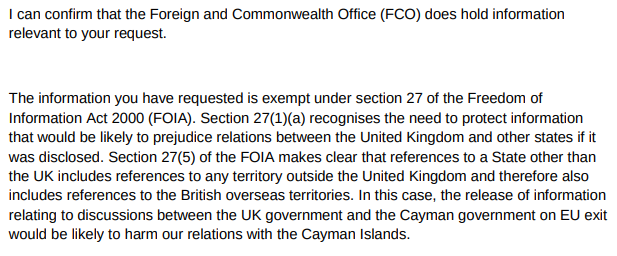

After a few delays they finally refused:

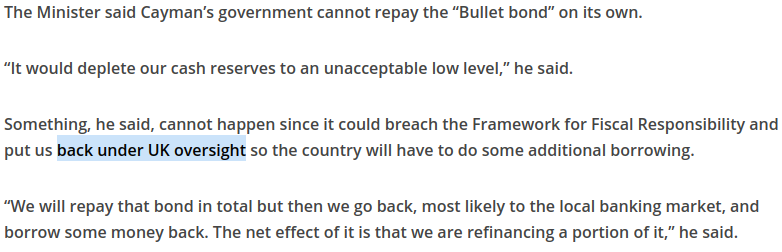

However this reveals two things, firstly, I touched a nerve! secondly it was the Cayman Islands that were concerned. What could they be worried about I wonder? Well it turns out that in 2009 the Cayman government issued a rather big bond that has to be repaid in full on 24th November 2019 – they call it a bullet bond. They can’t afford to pay it in full, so will need to refinance it. Roy McTaggart the finance minister explains the plan to refinance the loan but if there are problems with that plan it sounds like the UK taxpayer might need to step in.

Do I know that this refinancing is related to the concerns they have around the overseas decision? Nope, just speculation. Would they rather the UK doesn’t give itself and it’s tax havens a big kick square in the credit ratings just before going to the bond market to refinance this bullet bond? Yeah, I bet they would.

This is the end of the road for my little investigation – an FOI refusal and some cynical speculation is all I can muster. A real journalist might try to approach the other end of the conversation and find out if the Caymen Government would like to share the list of concerns they had, but that exceeds my level of determination.